sloganindividual

sloganpaymonade

slogandescindividual

suportcryptonum

suportcryptotitle

countrynum

countrytitle

fiatnum

fiattitle

useronbardedtitle

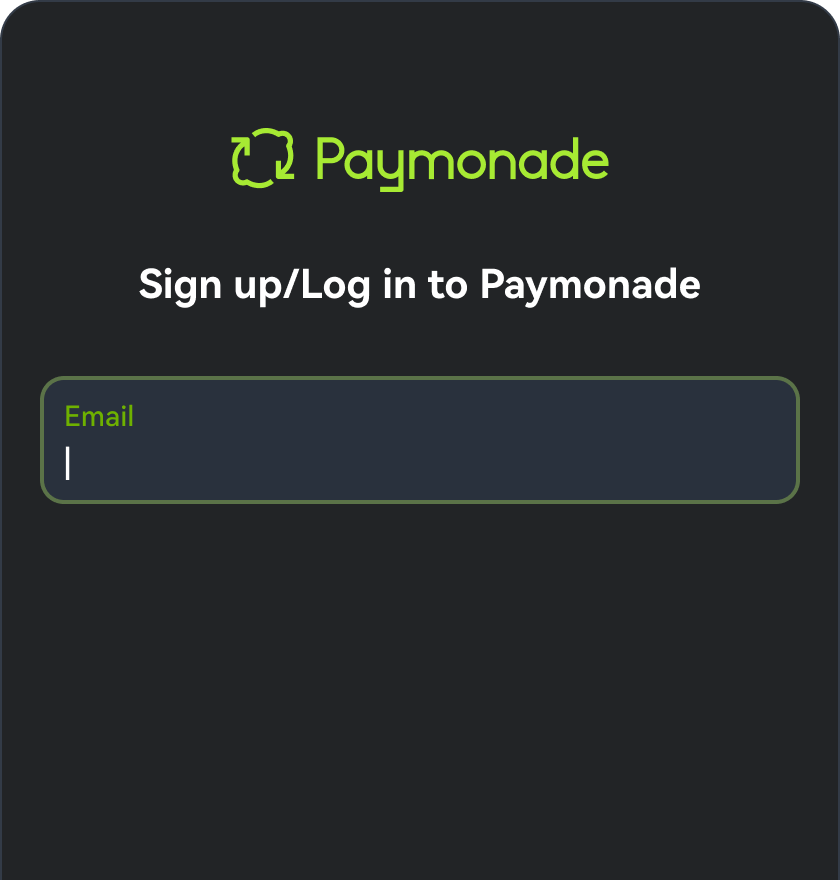

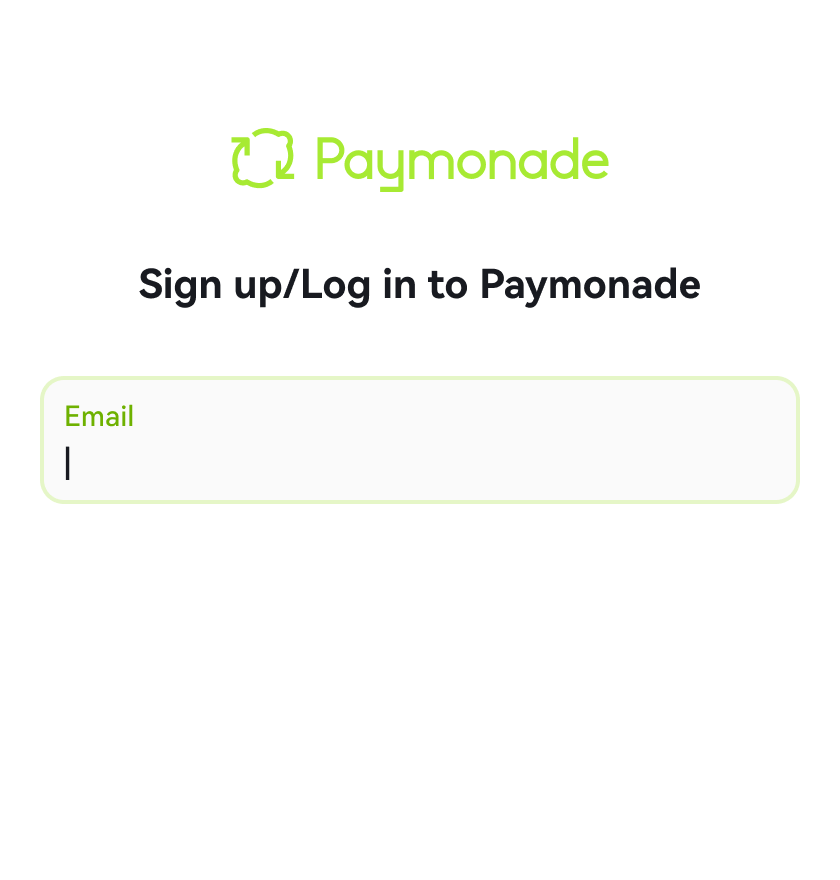

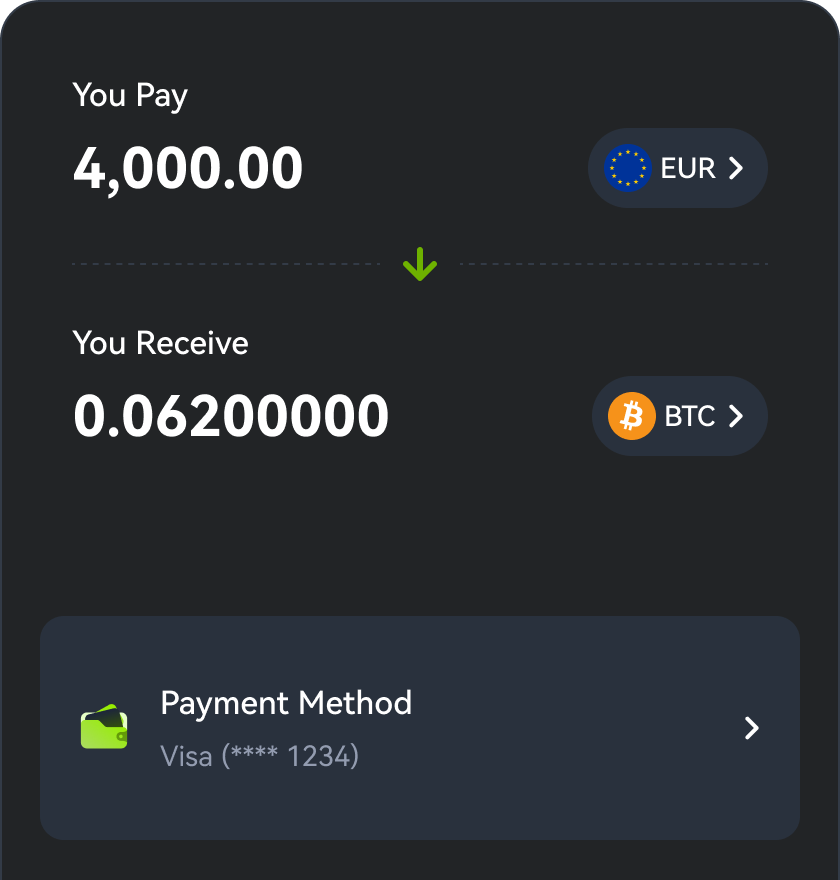

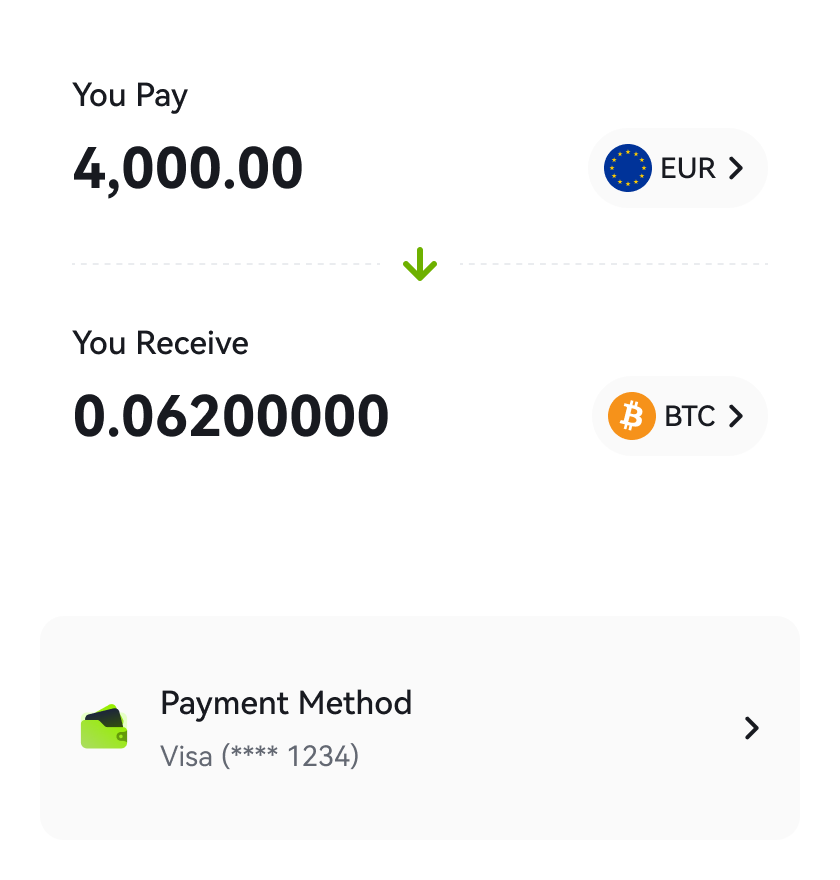

buysellintrotitle

buysellintrodesc

getstartednowtitle

whypaymonade

whypaymonadefiatcoverage

whypaymonadefiatcoveragedesc

whypaymonadecrypto

whypaymonadecryptodesc

whypaymonadepayment

whypaymonadepaymentdesc

whypaymonadetrade

whypaymonadetradedesc

whypaymonadefraud

whypaymonadefrauddesc

whypaymonadesupport

whypaymonadesupportdesc

getstartedtoday

getstartedtodaydesc